A Nigerian man has sparked massive reactions online after revealing the shocking repayment demand from a loan app, just over a month after borrowing.

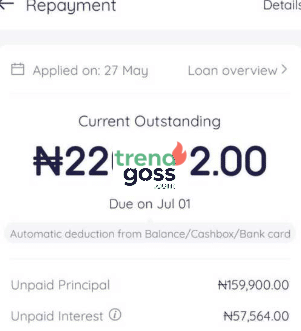

The borrower, who preferred to remain anonymous, disclosed that he took a ₦159,000 loan from PalmPay to handle an emergency. However, only 34 days later, the app requested a staggering ₦220,000 repayment — a difference of over ₦60,000.

In a Facebook post dated June 26, he shared a screenshot of his loan dashboard, lamenting his situation and seeking advice from fellow users.

He wrote, “I am owing PalmPay and it will be due on July 1. I don’t know how I am going to raise such an amount. I borrowed ₦159k for an emergency, and now I have to pay ₦220k plus in 34 days. Please, is there anyone owing PalmPay? How are you handling it? I will pay eventually but I don’t have it now.”

The post quickly went viral, drawing hundreds of reactions from Nigerians. While some sympathized with his plight, others criticized the loan app’s high interest rate and questioned his decision to borrow under such terms.

This incident has reignited online conversations about predatory lending practices and the growing burden of short-term digital loans in Nigeria.